23 years after its first publishing, there are still secrets to be mined from Rich Dad Poor Dad that will revolutionize your life!

I have spent the past 6 years earning a full-time income online, ultimately trying to implement some of the very principles taught by Robert Kiyosaki.

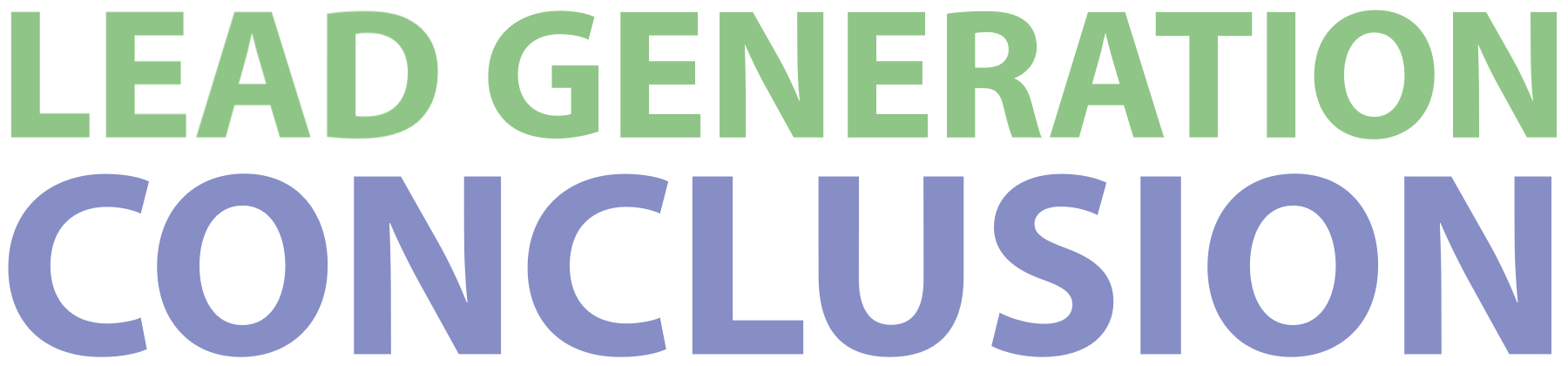

One strategy I’ve found for creating passive income is with local lead generation.

If you’re interested in learning more about that model, check out the box below.

About Robert Kiyosaki

1. Growing Up

Robert was born in Hilo, Hawaii in 1947 to 4th generation Japanese immigrants.

He and his three siblings were raised in a middle-class home with very strict, “by the books” parents.

His mother (Marjorie O. Kiyosaki) was a hard working registered nurse.

His father (Ralph H. Kiyosaki) was a highly educated man, earning a 4-year bachelor’s degree in just 2 years.

Then, he went on to complete advanced studies at Stanford University, the University of Chicago, and Northwestern University, all on full scholarships.

He was an educator and eventually became a high ranking government official on Hawaii’s State Board of Education.

When Robert was nine years old, he and his best friend Mike (Alan “Mike” Kimi) first started making money… literally.

Out of a misunderstanding, they collected old lead toothpaste tubes, burned off the paint, melted them down, and poured them into a plaster cast of a nickel in milk cartons.

They were making money… making nickels out of lead.

That is until Robert’s father explained to them that was a federal crime.

But this failure, like so many in entrepreneurship, led to something great: learning about money from Mike’s dad (Richard Wassman Kimi)*.

Both Robert’s father and Mike’s father were successful in their careers, working hard all of their lives.

Both earned really great incomes.

Yet, one seemed to always financially struggle, and the other went on to become one of the richest men in Hawaii.

Both offered Robert advice, each vastly different in their opinions.

This dynamic of having a highly educated, financially illiterate father, aka “Poor Dad”…

And a middle school dropout, highly financially literate father-figure, aka “Rich Dad”…

Is the general backdrop for the entire book.

Fast Fact: It wasn’t until after Richard’s death in Dec. 2008 that his identity was disclosed as the real Rich Dad, in order to help maintain the family’s privacy*

Growing up, Robert had the opportunity to constantly compare and contrast the advice of Rich Dad and Poor Dad.

Instead of only having one perspective, he was able to see these two separate ideas about a single issue.

Robert has stated in his books and interviews over the years that there are a lot of wonderful qualities that he inherited from his Poor Dad…

But he wouldn’t have become who he is today without learning the lessons he did from Rich Dad.

And countless lives have been impacted for the better because of it too.

2. Career

Growing up, a major lesson Rich Dad taught Robert was you do not work a job for money.

Instead, you work a job to learn.

So, Robert and Mike had the opportunity to work in various positions in Rich Dad’s companies while they were growing up.

Robert worked in Rich Dad’s accounting department, as a busboy, a construction worker, in sales, reservations, and marketing.

When Robert graduated high school in 1965, he was given congressional nominations for both the U.S. Naval Academy and the U.S. Merchant Marine Academy.

Robert chose to attend the Merchant Marine Academy in order to learn international trade.

He graduated in 1969 as a deck officer with a Bachelor of Science degree, plus commissioned as a 2nd Lt. in the U.S. Marine Corps.

He took a great, stable job with Standard Oil to be an oil tanker third mate.

His Poor Dad thought it was a great decision, stable income and 5 months of vacation.

Robert resigned after 6 months, and joined the Marine Corps.

He told his Poor Dad it was so he could learn to fly… but he really wanted to learn how to lead people.

Rich Dad had spent three years serving in the Army, and he told Robert that managing people would be one of the hardest tasks ahead of him as an entrepreneur.

In 1972, Robert served in Vietnam as a helicopter pilot for one year.

In 1973, while still in the military, he enrolled in a 2 year MBA program at the University of Hawaii at Hilo, but dropped out after seeing no real value in it thanks to years with Rich Dad.

He was honorably discharged from the Marine Corps in 1974, and took a job working at Xerox in order to learn how to sell.

By 1978, Robert was consistently one of the top salespeople at the company, but he invested his commissions into assets – specifically, real estate.

In less than three years, his real estate assets were producing more money than his high achieving efforts in Xerox.

So, after gaining all of the sales expertise he felt he could, Robert formed his very first company in 1977.

His goal was to learn how to form a company from the ground up, and his hope was to succeed at selling nylon and velcro wallets marketed for surfers.

That company eventually collapsed, but the main goal of learning was achieved.

He then started a retail shop that made t-shirts, hats, wallets, bags, etc.

That company also failed within the first couple of years.

In 1985, he and Doria (DC) Cordova co-founded Excellerated Business School to teach entrepreneurship, investing, and social responsibility.

They acquired the intellectual properties and rights to the teaching methodologies that were originally pioneered by Marshall Thurber and Bobbi DePorter in the late 1970’s.

Marshall and his team had originally proved their methods by growing their property development company, Hawthorne Stone, into explosive success.

They then took these methods and created the Burklyn Business School for Entrepreneurs, which is what was acquired by Robert and Doria.

Robert continued growing the business education company, until he sold his portion in 1992.

All the while, he and his wife Kim were also building up their personal asset portfolio.

So, in 1992, Kiyosaki ventured into authorship, publishing his very first book titled “If You Want to Be Rich and Happy, Don’t Go to School.”

Then, in 1997, Robert formed the Rich Dad Company, overseeing the Rich Dad branded products, including the eventual New York Times Bestseller “Rich Dad Poor Dad.”

Robert has gone on to form numerous other LLCs, corporations, etc.

Some with customer facing reasons, and others are for the legal and financial protections they provide.

They have come in handy for the numerous lawsuits that Robert has battled with over the years.

Overall, Robert has enjoyed massive success throughout his career…

Even though he didn’t start seeing real financial success until after he was 40.

All thanks to implementing the lifelong guidance of Rich Dad.

Today, Robert still maintains ownership of several LLCs and Corporations, the most branded one being Rich Dad Company.

Robert is continuing the mission of Rich Dad Company is “to elevate the financial well-being of humanity.”

He has an incredibly active social media following (including 1.58 million YouTube subscribers), and has produced more content in 2021 due to not being able to host seminars.

He also has joint venture partnerships with 17 companies ranging from personal finance, stocks, entrepreneurship, real estate, cryptocurrency, and even personal development.

I’m sure that he personally believes in these companies because he is able to present these companies to his incredibly broad audience base, and make some sort of commission on their purchases.

It’s yet another form of passive income for the Rich Dad.

3. Other Books Published

As mentioned before, Robert Kiyosaki published his first of more than 26 books in 1992.

By far his most famous title being “Rich Dad Poor Dad,” originally published in 1997.

This publishing career includes titles like:

- If You Want to Be Rich and Happy, Don’t Go to School! (first published in 1992)

- Rich Dad Poor Dad – What the Rich Teach Their Kids About Money, That the Poor and Middle Class Do Not! (first published in 1997)

- Cashflow Quadrant: Rich Dad’s Guide to Financial Freedom (first published in 2000)

- Rich Dad’s Guide to Investing: What the Rich Invest in, That the Poor and the Middle Class Do Not! (first published in 2000)

- Rich Dad’s Rich Kid, Smart Kid: Giving Your Children a Financial Headstart (first published in 2001)

- Rich Dad’s Retire Young, Retire Rich (first published in 2002)

- Rich Dad’s The Business School: For People Who Like Helping People (re-write of an earlier edition promoting MLMs; first published in 2003)

- Why We Want You to Be Rich: Two Men, One Message (co-written with Donald Trump; first published in 2006)

- Midas Touch: Why Some Entrepreneurs Get Rich and Why Most Don’t (co-written by Donald Trump; first published in 2011)

- Plus more than 17 other books

Chapter by Chapter Summary

4. Lesson One: The Rich Don’t Work for Money

Rich Dad’s first lesson was a big one: The Rich Don’t Work for Money.

After Robert and Mike had tried their hand at making money (literally), Rich Dad said he would make them an offer.

That offer was to come work for him for $0.10 per hour for 3 hours every Saturday, and he would teach them.

However, Rich Dad didn’t speak with the boys again for 3 weeks, and nine year old Robert was tired of being a slave for such little pay.

So, he decided he was going to quit, and that’s exactly what Rich Dad was waiting to happen.

He was trying to show Robert how to learn a lesson when life is pushing you around, instead of being like most people and just let it happen.

“If you learn this lesson, you will grow into a wise, wealthy, and happy young man. If you don’t you will spend your life blaming a job, low pay, or your boss for your problems. You’ll live life always hoping for that big break that will solve all your money problems.”– Pg.20

9-year old Robert was upset that he was being treated like this, but Rich Dad was making a point.

Most people want external sources to be the problem or cause for their situation, and demand those outside things to change.

They will simply wait on a raise thinking more money will solve their problems, or take on a second job working harder… to yet again accept a small paycheck.

Instead, Rich Dad said to use your brain to learn, grow, and change in order to solve the problem.

This was the foundation of the ultimate lesson number one:

“The poor and middle class work for money. The rich have money work for them.”

The reason most people in the poor and middle class work for money is because of a pattern driven by two emotions: Fear and Greed.

At first, people fear being without money, and that motivates us to work hard.

Then, once that hard work is rewarded with a paycheck, greed (desire) has us thinking about all of the wonderful things money can buy.

That then sets the pattern of getting up, going to work, paying the bills, over and over… all driven by fear and greed.

Even the rich can be driven by fear and greed… fear of being poor, what their friends might think if they lost it all, etc.

What is the predominantly fear driven recommendation from most people?

Stay in school, get good grades, find a secure job, retire with benefits.

This is the script that most parents offer their kids because they’re afraid they won’t make enough money to survive, or they won’t fit into society.

This fear also drives us into a false sense of security with going to a job everyday to earn a salary.

A job is far more riskier than most people think, because the control is completely out of your hands.

Yet, this is where most people find themselves today, and that’s mainly because of fear and ignorance.

“Most people live their lives chasing paychecks, pay raises, and job security because of the emotions of desire and fear, not really questioning where those emotion-driven thoughts are leading them. It’s just like the picture of a donkey dragging a cart with its owner dangling a carrot just in front of its nose. The donkey’s owner may be going where he wants to, but the donkey is chasing an illusion. Tomorrow there will only be another carrot for the donkey.”-Pg. 55-56

The moment fear or desire start making decisions, it’s the beginning of ignorance.

Only by continuing to learn and grow… opening the mind, can illumination overtake ignorance.

Soon, your mind will start to see things that others are missing.

It will find a way to make money, without being driven by fear, greed, or ignorance.

That’s what happened to Robert and his friend Mike after Rich Dad wanted the boys to work without getting paid, reducing from the previous $0.10 per hour.

After a few weeks, the boys started noticing that the superette manager kept cutting the top half of the front page off of older comic books, and then throwing the rest of the book away.

This was so she could get a credit from the comic book distributor when he delivered new comics.

The boys had it, and they started gathering up hundreds of comic books in Mike’s basement.

They opened up their “comic book library” to kids, charging $0.10 for a two hour admission (which was the normal cost of purchasing a brand new comic book).

They paid Mike’s sister $1 per week to be the librarian and keep track of visitors, and the boys made $9.50 per week for a three-month period.

They simply had to be willing to not work for money, and let their money work for them.

5. Lesson Two: The Rich Learn How Money Works

The real challenge in life isn’t how much money you can make…

It’s how much you can keep.

That is the difference and power of being financially literate.

Rich Dad drilled this into Robert’s head almost every time they were together.

Poor Dad stressed the importance of reading books, while Rich Dad stressed the need to master financial literacy.

This is the foundation of becoming and staying rich.

How many times have you heard of a lottery winner losing it all?

Or what about professional athletes getting paid millions of dollars, only to become homeless soon after their playing days were done?

Perfect examples of the lack of financial literacy.

Financial literacy includes getting a fundamental understanding of accounting, investing, markets, taxes, inflation, and the law.

Financial concepts can be complex, but the more you can grasp them…

The more successful you will be in business.

Rich Dad did this for Robert and Mike when they were just boys, and the most important rule of financial literacy is…

“Rule #1: You must know the difference between an asset and a liability, and buy assets.”

“Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.”

It is a very simple concept, yet most adults miss it because of its simplicity.

An asset puts money into your pockets, while a liability takes money out of your pocket.

Rich Dad taught these with simple pictures, like this:

Understanding this is important to become financially literate in words and numbers…

That is if you want to be rich and maintain your wealth.

Cash flow tells the story of how a person handles money.

One of the biggest mistakes most people make is thinking they need to make more money.

Why?

Because money highlights the cash flow pattern running in your head.

For example, if your cash flow pattern is to spend everything you get, then an increase in income will also result in an increase in expenses.

This is also why there are so many millions of students who worked diligently in school to go to college, learn a profession, yet still struggle financially.

They don’t need to know how to make more money…

They need to learn how to manage it.

Here is the cashflow pattern of a liability…

This is called financial aptitude – “what you do with the money once you make it, how to keep people from taking it from you, how to keep it longer, and how to make that money work hard for you.”

So why do the rich keep getting richer?

Because they use their financial intelligence and aptitude to continue growing their assets, instead of liabilities thinking they are assets.

Their assets generate more than enough income to cover their expenses, and they reinvest the extra into more assets.

These new assets only help to continue to grow their income, which in turn continues to grow their assets.

Why do the middle class continue to struggle?

Since their primary income source is from a job, their wages get hit with incredibly high taxes.

Their expenses also tend to grow on pace with their income.

Plus, they treat their home as their primary asset, even though it ties up all of their money and increases their expenses.

Instead of investing in income-producing assets, they are left in a constant cycle Kiyosaki calls “the Rat Race.”

6. Lesson Three: The Rich Mind Their Own Business (Assets)

The poor and middle class employee works for almost everyone else except themselves…

They work first for the owners of the company, helping to establish their vision and make them money.

Next, they work for the government by paying 7.5% in taxes (15% if you include what their employer pays the government instead of them).

Finally, they work for the bank that owns their mortgage, and all of their other outstanding liabilities.

And so continues the financial struggle… because the employee is always working for someone else.

Here is the cash-flow of a poor person…

The prevailing thought about education is to get good grades, get a good professional education, and get a good job.

Acquiring these professional skills allows people to enter the workforce and work for money…

But it also centers their income around their profession.

Here is the cash-flow pattern of the middle class…

What the rich understand is that there is a big difference between your profession and your business.

This is why the rich become and stay rich, they mind their business… aka their asset column.

Here is the cash-flow pattern of the rich…

Not the fake assets that most of the middle class have bought into from a salesperson…

Like a home (only an asset the moment it is sold-but then comes a tax), new car (loses 25-45% value the moment it’s off the car lot), or other fancy stuff (resale value is much lower than claimed value).

Solid Assets Suggested by Robert

- Businesses that do not require my presence. I own them, but they are managed or run by other people. If I have to work there, it’s not a business. It becomes my job.

- Stocks

- Bonds

- Income-generating real estate

- Notes (IOUs)

- Royalties from intellectual property such as music, scripts, and patents.

- Anything else that has value, produces income or appreciates, and has a ready market.

Does this mean you should quit your day job to start minding your business?

Absolutely not!

In fact, unless you really want to, the odds are against it succeeding.

Nine out of every ten companies that start fail within five years.

Of those that make it past 5 years, nine out of ten will eventually fail too.

So you should keep your day job and diligently build your assets until your assets can replace your salary.

But, that is going to take intentional investing on your part.

The rich actually buy their luxuries last, while the poor and middle class tend to buy them first.

The old money people build their asset columns first, and then buy luxury items from the income generated.

“The poor and middle class buy luxuries with their own sweat, blood, and children’s inheritance.”-pg.77

Playbook to Becoming Rich

1

Keep expenses low

2

Reduce liabilities

3

Diligently build solid assets

7. Lesson Four: The Rich Use Corporations

This is quite possibly the most significant secret of the rich.

When income taxes were first permanently installed in the United States with the 16th amendment in 1913, most people thought that this was a way for the rich to pay their fair share.

This “Robinhood economics” made the poor and middle class feel great… until the government needed more tax dollars.

Then the standards were lowered, to where now it hurts them the most.

What did the rich do?

What they have been doing since the 1700’s!

credit: britanica.com

In order to minimize their risk to the assets of each sea voyage, the rich created corporations as a financial vehicle.

The rich would create a corporation that would then hire a crew to sail across distant waters looking for new treasure or trades.

If the ship and crew were lost at sea, the damage to the rich would only be the money they invested into that particular voyage.

Robert learned this first hand from Rich Dad (a capitalist) and Poor Dad (a socialist).

“It seemed to me that the socialists ultimately penalized themselves due to their lack of financial education. No matter what the ‘take-from-the-rich’ crowd came up with, the rich always found a way to outsmart them. That is how taxes were eventually levied on the middle class. The rich outsmarted the intellectuals solely because they understood the power of money, a subject not taught in schools.” – pg. 83

For those who have never created a corporation, the biggest surprise is that it’s not actually a real thing.

A corporation is simply a legal document that has been registered with the state governing agency.

This little piece of paper provides asset protection, a lesser income-tax rate than for individuals, and certain expenses can be paid by the corporation.

The rich are aware of these things because they are minding their business, rather than spending all of their resources building someone else’s.

8. Lesson Five: The Rich Grow Their Financial IQ

Absolutely every person has tremendous potential.

Each one has gifts, skills, or talent that is absolutely mind blowing.

However, we all face the same thing that holds us back from achieving our potential…

Self-doubt, not in technical knowledge or competency, but the lack of self-confidence.

“Often in the real world, it’s not the smart who get ahead, but the bold.”-pg.92

The world is constantly changing and evolving, and that can be an exciting time or a terrifying time…

It all depends on your financial IQ.

By developing your financial IQ, you will be able to open yourself up to more opportunities in the future.

The foundation of a financial IQ is made up of four broad areas of expertise…

Foundation of Financial intelligence

- Accounting

- Investing

- Understanding Markets

- The Law

Even though these are the basics, it actually takes the synergy of many skills and talents working together to truly achieve a high financial IQ.

One example Robert presents of the fundamentals, understanding markets, is by recognizing where the wealth is.

Hundreds of years ago, in an agrarian society, wealth was in land ownership.

During the industrial revolution, wealth was in owning factories and production.

Today, wealth is in information, and those with access to the timeliest info owns the wealth.

Robert also designed a game to help people learn how money works called CASHFLOW®.

The game helps to give people experience using financial IQ to make informed decisions.

There is also a free version available for play on Robert’s website, RichDad.com

At the end of the day, financial intelligence is simply about having more options.

- If the opportunities aren’t coming your way, what else can you do to improve your financial position?

- If an opportunity lands in your lap and you have no money and the bank won’t talk to you, what else can you do to get the opportunity to work in your favor?

- If your hunch is wrong, and what you’ve been counting on doesn’t happen, how can you turn a lemon into millions?

That, Kiyosaki says, is financial intelligence.

Sadly, most people just have 3 options: work hard, save money, and borrow money.

Having financial intelligence allows you to create both luck and money.

“The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth seemingly instantaneously.”-Pg 98

9. Lesson Six: The Rich Work to Learn

As Robert’s life has demonstrated, the rich do not work for money…

They work to learn.

As this chapter notes, many people are just one skill away from great wealth.

When he was learning from Rich Dad, Robert was thrown into numerous “jobs” in order to learn.

He learned (worked) in accounting, sales, marketing, reservations, construction, and busing tables.

Robert went to the U.S. Merchant Marine Academy to learn international trade.

After graduating, he landed a stable job with Standard Oil, but left after only 6 months.

He left to join the Marines in order to learn how to lead people.

After touring in Vietnam, Robert resigned his commission and got a job at Xerox.

Why?

Because they had one of the best sales training programs in America, and Robert needed to learn how to sell.

After four years, he had sufficiently overcome his fears and was consistently selling in the top five at his company.

This philosophy doesn’t fit most people’s paradigm, like Poor Dad.

Job security is everything to the majority of people like Poor Dad, while learning was everything for Rich Dad.

Robert recommends taking a longer view at your life, and taking jobs that will allow you to learn the skills necessary to navigate to your destination.

However, if you do happen to follow the path pushed by the education system of specialization, then join a good union. This will help protect you long term since you are dedicating your life’s skill to a single industry where it is valuable, such as a teacher or a pilot.

The sad reality is that the world is full of really talented and gifted people who are either poor, struggling financially, or are earning less than they are capable of because of what they do not know.

They focus on refining their skills in creating/building a better product, instead of the skills needed to sell and deliver the product.

His example is McDonald’s, who agreeably do not make the best burger in the world, yet they are the best at selling and delivering a basic average burger.

The most important skills to learn are sales and marketing.

Most people find sales and marketing difficult primarily due to their fear of rejection…

“The better you are at communicating, negotiating, and handling your fear of rejection, the easier life is.” – Pg.126-127

The rich are constantly growing and maintain a growth mindset…

Giving themselves to becoming better communicators, learners, sellers, marketers, leaders, teachers, students, and givers.

The rich work to learn.

10. Lesson Seven: The Rich Train Themselves to Overcome Obstacles

“The primary difference between a rich person and a poor person is how they manage fear.”

There are five reasons why, even after people become financially literate, they can’t seem to break through to financial independence.

- 1Fear

- 2Cynicism

- 3Laziness

- 4Bad Habits

- 5Arrogance

Fear is a big problem that everyone has… but it’s how you handle fear that matters.

Most of the time this fear is the fear of losing money, and it can be a real phobia.

If you approach the possibility of losing, unable to overcome that fear, most likely you won’t act.

That’s the reason why most people don’t win financially: the fear of losing money is greater than the joy of being rich.

For winners, losing inspires and challenges them to grow and fuels them to overcome.

For losers, losing defeats them.

This is one of the greatest secrets of winners, since losing inspires them, they aren’t afraid of it… and that is winning!

Most Americans struggle financially because they play not to lose, instead of playing to win.

Maintaining balance is playing it safe… playing not to lose.

Every single person who has ever gotten ahead has gone all-in.

FOCUS = Follow One Course Until Successful

To really succeed, it takes guts, patience, and a great attitude toward failure.

Cynicism is that negative noise that’s either created in our head or from the outside.

The constant barrage of doom and gloom cast a constant shadow on the potential future.

It takes great courage to act in the face of such negativity, but those who do act usually win.

Rich Dad said, “Unchecked doubt and fear creates a cynic… cynics never win.”

Why?

Criticism closes down the mind, and blinds you to opportunities for success.

“The ‘I-don’t-wants hold the key to your success”

Many people focus on what they don’t want to do, and that is often the cynical noise blocking them from grand opportunities.

Laziness can be tricky to pin point because the most common form of laziness is staying busy.

Most people are too busy working, with the kids, watching TV, going fishing, shopping, ect…

To focus on their health and wealth.

Kiyosaki says the only way to fix this is with a little greed, or desire.

Have a little desire for the things you do want out of life, and use it as fuel to go get them.

Rich Dad believed that the words “I can’t afford it” shut down your brain, and exposed your laziness.

Instead, you should ask “How can I afford it?”

Instead of being lazy and saying “I can’t afford it,” you should ask “How can I afford it?”

This opens up possibilities, excitement, and dreams… creating a stronger mind and a dynamic spirit.

But keep your desire in check, and your greed in moderation.

Bad habits control our lives and more than anything else are the root cause of our struggles.

“Our lives are a reflection of our habits more than our education.”-Pg.142

One bad habit of the poor and middle class is they pay everyone else first and pay themselves last (if there’s anything left over at all).

Rich Dad always taught to pay yourself first, even if you’re short on money.

Long term, this habit is one of the only ways to build your asset column, instead of always being stuck chasing the next dollar.

Sure, the bill collectors will try to bully you into paying them first, but that’s because it is in their best interest to collect payments asap.

It is in your best interest to pay yourself first to get financially and mentally stronger.

Plus, Robert uses the added pressure to help fuel his creative thinking in order to find the extra money needed to stop the bill collectors from screaming.

Arrogance is often used to hide ignorance.

“What I know makes me money. What I don’t know loses me money. Every time I have been arrogant, I have lost money. Because when I’m arrogant, I truly believe that what I don’t know is not important.” – Pg. 144

Instead of trying to look important, when you clearly don’t know what you’re talking about…

Start educating yourself about it.

10 Actions to Apply “Rich Dad” Principles Today

11. Action #1: Find a reason greater than reality [The Power of Spirit]

The road to financial freedom is long, and comes with many challenges.

Before you start, really dig in and find a reason greater than your reality as to why you want to do it.

This is often a combination of “wants” and “don’t wants,” and they are often emotionally significant.

You will need this when (not if) things get hard.

THERE IS NO SENSE IN GOING BEYOND THIS ACTION STEP UNTIL YOU COMPLETE IT. IT’S THAT IMPORTANT!

12. Action #2: Make daily choices [The Power of Choice]

“Financially, every dollar we get in our hands, we hold the power to choose our future: to be rich, poor, or middle class.”

The habits you have reflect who you are, and people who are poor have poor spending habits.

Habits are formed by our daily choices, and most of the population chooses not to be rich.

What we do with our time, our money, and what we do/do not learn is how we make daily choices.

It is a choice to be rich, made every day, long before the bank account reflects it.

13. Action #3: Choose friends carefully[The Power of Association]

You shouldn’t choose friends based on their financial statements…

However, those who have money tend to be interested in discussing and learning more of the subject matter.

Those who do not have money, tend to be chronically frightened or are living reinforced by poor habits.

You want to be constantly growing and learning more about how to grow, and that is why it is important who surrounds you.

Real money is often made on trading information, and that is what friends are for.

14. Action #4: Master a formula, then learn a new one[The Power of Learning Quickly]

There’s no difference between making bread and making “dough.”

A baker will follow a recipe (even if it’s in his/her head), and making money is the same.

Kiyosaki says to be careful what you study because our minds actually become it.

Whenever you find a formula that works (beyond the standard: Work for money), then focus on it until you’ve mastered it.

In today’s world, it isn’t as much about what you know, but how fast you can learn.

Being able to learn (and unlearn) quickly will be the greatest skill you can acquire in the 21st century.

15. Action #5: Pay yourself first[The Power of Self-Discipline]

Self-discipline is an absolute must on the journey to becoming rich.

Robert claims that “personal self-discipline is the number-one delineating factor between the rich, the poor, and the middle class.”

Paying yourself first is a concept that comes from George Clason’s book, The Richest Man in Babylon.

This doesn’t mean be irresponsible and not pay your bills.

This means pay yourself first… save, invest, build your asset column.

It takes self-discipline and inner fortitude to go against the grain of society like this, but that’s what it’s all about.

Rule #1 in paying yourself first: Don’t get into consumer debt in the first place!

“To be successful paying yourself first,

- 1Don’t get into large debt positions that you personally have to pay for. Keep expenses low. Build up assets first. Then buy the big house or nice car. Being stuck in the Rat Race is not intelligent.

- 2When you come up short, let the pressure build and don’t dip into your savings or investments. Use the pressure to inspire your financial genius to come up with new ways of making more money, and then pay your bills. You will have increased your ability to make more money as well as your financial intelligence.”

16. Action #6: Pay your brokers well[The Power of Good Advice]

Discount advice equals discounted earnings.

Rich Dad taught the importance of paying professionals well, because if they were your business professionals, they should be making you money.

If these business professionals are paid well for their efforts, they will make you more money.

Remember, not all brokers are good brokers.

Kiyosaki interviews his paid professionals, and asks them how much property or stocks they personally own, and what percentage they pay in taxes.

He is looking for someone who serves in a profession, but is passionate about the same business as him.

That way, he knows they actually have his best interests in mind.

17. Action #7: Be an Indian giver[The Power of Getting Something for Nothing]

When European immigrants first encountered the native Indians of North America, a cultural misunderstanding occurred.

When the natives saw that the new people were cold, they loaned them blankets, but the Europeans thought the blankets were gifts.

So, when the Indians wanted the blankets back, the Europeans got offended, and when they seemed unwilling to return them, the natives got offended.

Thus, the term “Indian giver” was created, and it is a vital concept to building wealth.

This is answering the two questions of a sophisticated investor, “how fast do I get my money back?” and “how much am I getting in return?”

Not only are you looking to see when you can get your money back…

But you are also looking at what new assets you get in return.

18. Action #8: Use assets to buy luxuries[The Power of Focus]

In theory, building up your asset column seems easy.

In reality, it takes an incredible amount of self-discipline and mental fortitude month after month to keep pointing money towards assets, instead of spending it on stuff we want now.

Using assets to buy luxuries is the result of learning how to make money work for you.

Instead of borrowing money to get things we want, we need to learn how to create money (no, not like 9-year-old Robert’s nickel scheme).

To do this, you must increase your financial intelligence.

If you become smarter than money, it will work for you…

Until then, you will be working for it.

19. Action #9: Choose heroes[The Power of Myth]

As children know all too well, pretending to be a hero is true power learning.

By emulating a beloved hero, in any given situation, we can take on their courage and strength…

“We tap into a tremendous source of raw genius” – pg.164.

They inspire us, and also convince us to want to be like them by making it look easy.

Finding heroes who make it look easy.

20. Action #10: Teach and you shall receive[The Power of Giving]

Rich Dad and Poor Dad gave generously of their time and knowledge to educate others.

This was their way of lending good back into the world.

Poor Dad almost never gave away money though, stating that he would whenever there was any extra…

There rarely was any extra.

Rich Dad always gave away money, even when he was short of it.

And he was rarely ever short of it.

“Whenever you feel short or in need of something, give what you want first and it will come back in buckets.”

This works for everything from money to a smile.

The more you teach those who want to learn, the more you will learn.

Robert notes, ”There are times when I have given and nothing has come back, or what I have received is not what I wanted.

But upon closer inspection and soul searching, I was often giving to receive in those instances, instead of giving for the joy that giving itself brings.”

Robert’s Immediate To Do’s

step 1

Stop doing what you’re doing now.

Assess what is working and not working. Stop doing what is not working, and look for something new.

step 2

Look for new ideas.

Robert goes to bookstores to search for different and unique subjects for investing ideas. He looks outside the box, so should you.

step 3

Find someone who has done what you want to do.

Take them to lunch and ask them for tips and tricks of the trade. You’ll be surprised at the amount of information you might find out that can rapidly speed up your process.

step 4

Take classes, read, and attend seminars.

There are many that are free or at least inexpensive to attend. There are also expensive ones. Robert searches for new and interesting ones, and attributes his wealth and freedom to those he invested in attending.

step 5

Make lots of offers.

For Robert, real estate is his investing vehicle of choice, so this is a term from that world. However, it can work across the board. Bottom line, get in the game. Make offers to people. Take action. No house is bought without an offering being made. No result is achieved without an action being taken.

Pros of Rich Dad Poor Dad

21. Life Changing

There are some moments in your life that you can point to as being monumental in shaping the trajectory of it.

Reading this book was one for me, as well as countless others.

22. Simple

It can be very overwhelming facing a subject matter that we don’t know a lot about, especially one that might be as sensitive as our money might be.

The messages in this book are taught using storytelling, and are simple enough for teens to understand.

23. Fundamental Knowledge (not taught in schools!)

What’s taught in this book is an amazing starting point for a good perspective on personal finances.

It’s too bad that many people aren’t getting this quality info in school or at home.

Read it, apply it, and teach it… that will help pass it along.

Cons of Rich Dad Poor Dad

24. Marketing Overload

I wouldn’t say it’s outright spam, but you will get bombarded with marketing on every front accessible from the Rich Dad Company.

They are doing their job well of selling you the lower tier products in order to get some into the higher tier stuff.

Just be aware.

25. Lots of Negativity with Rich Dad Seminars

The Rich Dad seminars came under a tremendous amount of heat in recent years.

Granted, they were operated by a completely different company with a license to use the Rich Dad brand, and Robert was not a facilitator.

In fact, he wasn’t involved at all.

From the website, it appears that Robert has brought that back under his direction.

26. Some Financial Experts Disagree

There are a lot of financial experts who disagree with some of Kiyosaki’s teachings.

Particularly, his rather cavalier approach to introducing people to financial practices that can be rather complex and nuanced.

Many claim that his teachings could lead to financial ruin if attempted incorrectly.

Concluding Thoughts

27. What I’ve taken away from Rich Dad Poor Dad

Rich Dad Poor Dad really opened my eyes to seeing the world as it was…

Instead of maintaining my allegiance to the way I was taught the world was.

From that moment until now, it has become a passion of mind to continue growing my financial intelligence…

And finding creative ways to free up my time by growing my asset column.

I’ve tried multiple online and offline avenues in an attempt to build assets…

Eventually finding the one that works for me.

It’s simple to understand, and easy to learn if you are willing to put in the effort.

Conclusion

Hey I hope you enjoyed this review of Rich Dad Poor Dad, you really can’t go wrong with this book, I learned a lot from Robert Kiyosaki.

The path to financial freedom according to Kiyosaki is through the establishing of assets, which put money in your pockets, rather than taking it out of your pocket.

I’ve made my fair share of $$$ with online with dropshipping, affiliate marketing, Amazon FBA, but after grinding at it for over 6 years I’ve realized that these biz models are not that great long-term because they don’t help create assets… they just create a lot of work with only modest financial returns.

I invested a lot in courses and mentors, but regardless of all the tips & tricks from these coaches, they simply cannot match the true passive income potential I’ve found in another online business model called local lead generation.

This is why today, I have quit dropshipping, affiliate marketing, and Amazon FBA altogether and do local lead generation instead. Click on the button below where I go in-depth on the main reasons why I believe local lead gen is a better business model than affiliate marketing…

I Quit Affiliate Marketing

Here’s what I’m doing now Instead…

Local lead generation… Where we build & rank simple websites like these that make passive income

Click button below to find out Top 6 Reasons Why Lead Gen is a Better Biz Model than Affiliate Marketing in 2021 & How to get started with Lead Gen!

Local Lead Generation

Schedule your coaching call today